A straightforward, low-interest loan tailored to Connecticut’s small businesses and nonprofits.

THE CONNECTICUT SMALL BUSINESS BOOST FUND is a new resource that will move your business forward.

Supported by the CONNECTICUT DEPARTMENT OF ECONOMIC & COMMUNITY DEVELOPMENT, the Fund links you to the financial support you need to thrive.

Many small businesses and nonprofits in Connecticut experience barriers to accessing financial resources. This is especially true for organizations in distressed municipalities and those led by women, individuals with disabilities, veterans, and people of color.

The Connecticut Small Business Boost Fund was created to provide access to working capital for those who need it most, supporting a greater economic recovery for Connecticut. Expand the tabs below to learn more.

Once you've reviewed the information, be sure to visit CTSMALLBUSINESSBOOSTFUND.ORG to pre-apply.

THE CONNECTICUT SMALL BUSINESS BOOST FUND is a new resource that will move your business forward.

The program is supported by the Connecticut Department of Economic and Community Development, and designed to help you access funds at a competitive interest rate so you can prepare for the future.

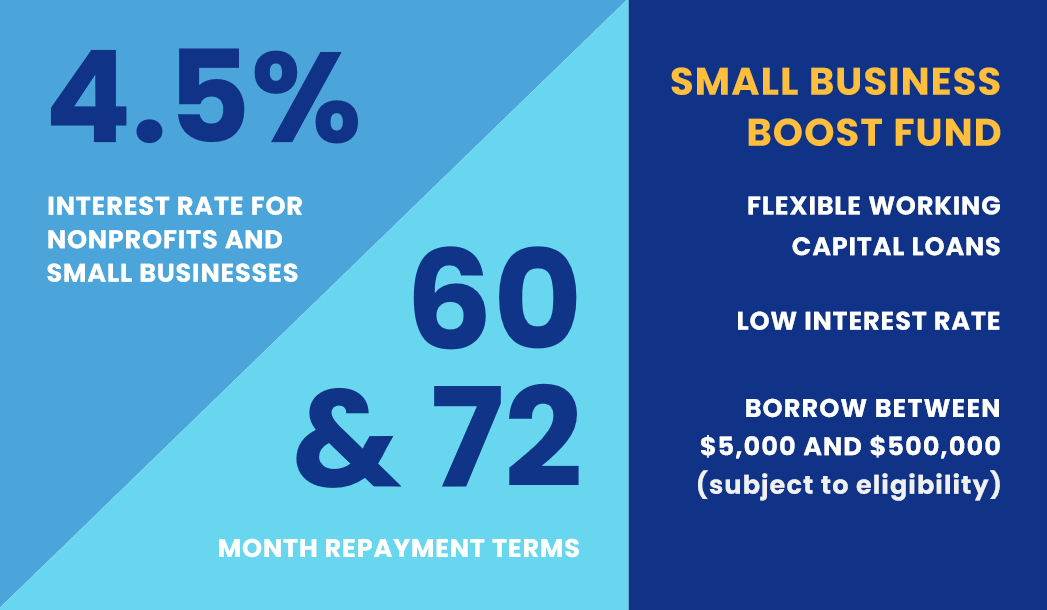

You can borrow:

- Between $5,000 - $500,000

- At a 4.5% fixed interest rate

- With no origination fees

- And a repayment term of either 60 & 72-months

Through the Connecticut Small Business Boost Fund, you can work directly with local community lenders that have extensive small business lending experience. The platform is a one-stop shop for business owners, where you can get business support and guidance before, during and after the loan application process.

ELIGIBILITY REQUIREMENTS

ELIGIBILITY REQUIREMENTS

- Must have operations in Connecticut

- No more than 100 full-time employees

- Annual revenues of less than $8 million

- Businesses and nonprofits must have been in operation for at least 1 year prior to the date of application

- A small amount of financing is available for start-ups

Please note: Even if you meet these conditions, you will be disqualified if you have:

- Active bankruptcies

- Unpaid child support

- Outstanding tax liens/judgments

You also must be up-to-date on all your state obligations (local and state taxes, and any prior state lending programs), and you must show you have the ability to repay this loan.

INELIGIBLE APPLICANTS:

Include:

- Corporate-owned franchises

- Payday loan stores

- Adult bookstores, strip clubs, or massage parlors

- Passive real estate investments

- Lobbying firms

- Pyramid sales schemes firms

- Cannabis businesses or firms engaged in activities that are prohibited by federal law or applicable law in the jurisdiction where the business is located

- Gambling

- Speculative business firms such as commodity futures trading or passive real estate investing

- Applicants delinquent on another similar loan

- Loan applicants that are delinquent on state or local taxes

Applicants delinquent on any state obligations

THE BASICS

- Fixed Rate 4.5%

- Repayment:

- Up to 60 months > $150k

- Up to 72 months < $150k

There is a three-month, optional deferment period where you can opt only to pay the interest. These three months are fully amortized over the remaining term.

But you do NOT have to choose to defer, you can opt to start repayment right away. This will make each monthly payment smaller.

Importantly, there is no prepayment penalty

The approval timeline will depend on the lender and the readiness of your loan package. An incomplete package (without the necessary documents, files, etc.) will result in delays.

There is no loan forgiveness, nor job creation requirements for this program.

USE OF FUNDS

Small businesses and nonprofits can borrow between $5,000 and $500,000 depending on eligibility and need and can choose how they spend the money - on:

- Start-up Costs

- Working Capital

- Franchise Fees

- Equipment, Inventory or Services to make or deliver goods/services

- Leasehold Improvements/renovations

- Tangible & Intangible Assets (not mortgage)

- Eligible Refinancing

COLLATERAL & GUARANTEES

- Personal guarantees are required for any 20%+ owner

- They may also require a UCC-1 general filing (UCC-1 Financing Statements, commonly referred to as simply UCC-1 filings, are used by lenders to announce their rights to collateral or liens on secured loans)

-

- For smaller amounts, they may have flexibility

ELIGIBLE LOAN AMOUNT

The maximum loan amount an applicant is eligible for will be calculated as the lesser of the best 6-month average revenues before the application date with a maximum loan amount of $500,000 (applicants can look at 2019 if the business/organization was significantly impacted during the pandemic).

While the use of funds does include repaying higher-interest debt, the repayment has to result in a 30% cash flow benefit. It is not meant to pay off debt from CDFI lenders but rather high-interest debt such as business credit cards, internet loans, etc.

Remember > You must show your ability to repay the loan. Lenders will be looking for:

- Positive cash flow in the most recent fiscal year or calendar 2019

- Your debt service coverage ratio must be 1.15 on a historical and projected basis

- Year-to-Date financial statements need to be provided (income statement at a minimum)

Startups:

- Must show outside income or that guarantor can support debt service coverage ratio of 1.15

- Will need to document 10% equity injection or availability of funds to invest into the project

REQUIRED DOCUMENTATION

Lenders May Require

Business Financials:

- Two most recent business tax returns, internally prepared financials, or other proof of revenue

- Year-to-Date Income Statement for the current year

- Financial projections as required by the lender (very important to prove debt service coverage)

Other Required Business Documents:

- Business Plan

- Copy of lease agreement and/or recent utility bill if required by the lender

- Attestation regarding being up to date on all local taxes

- No defaults on any state financial assistance or obligations

- Valid operating license if applicable (childcare, food service, liquor, professional)

- Letters from CT Department of Revenue Services providing evidence of being up-to-date with all tax obligations, CT Secretary of State Letter of Good Standing, CT Department of Labor evidence of good standing (lenders will pull these; you must make sure you are up-to-date)

Ownership/Legal:

- Schedule of Ownership (lists all owners of the business)

- Photo ID for all 20%+ owners

- Credit checks for all 20%+ owners

- Executed Attestation form

- Evidence of legal formation (CT Secretary of the State's filing)

NO-COST, CONFIDENTIAL, PROFESSIONAL SUPPORT

As you noticed in the documentation section, there are several important pieces of information you will need to provide as part of the loan application process.

We can assist you in:

- Determining if you are eligible to apply and understanding the program details and conditions.

- Providing a Business Plan Template

-

- And helping you with edits, feedback, and the necessary industry/market research information

- Working on Financial Projections

- Including analyzing your current financial statements to put your best foot forward

- And benchmarking your projections to ensure they meet industry standards

- Reviewing Your Lending Package

- To have a second set of experienced eyes who can help make sure your package is accurate and complete, so the overall lending process is easier and faster

Register for No-Cost Business Advising to get started, or reach out directly to your advisor if you are already working with someone.