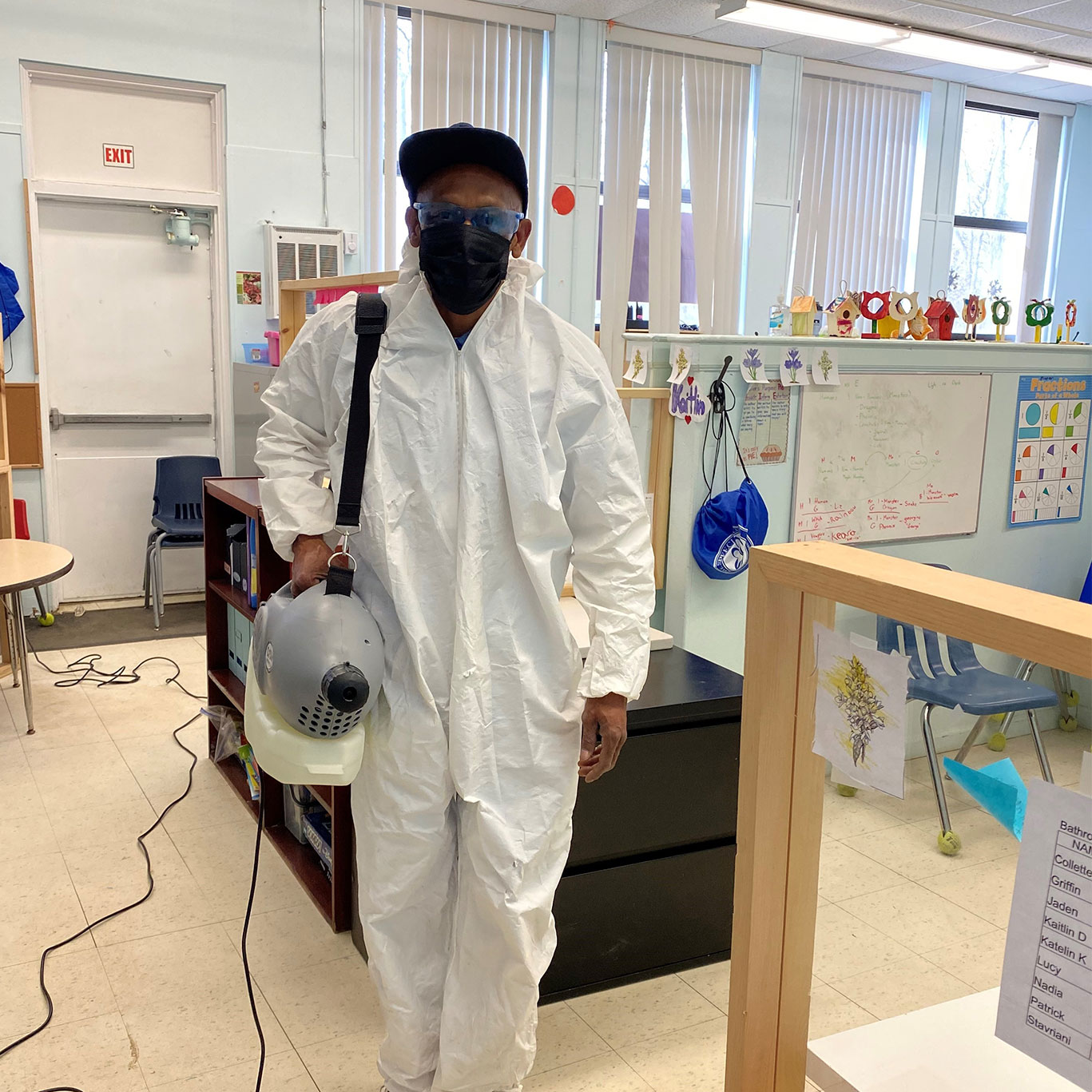

Darryl started his own commercial cleaning business after having worked in the industry and seeing the potential owning his own business could have. With the help of his CTSBDC business advisor, Darryl was able to continue operating his business during 2020 when many of his clients were closed due to the nature of their business.

Capital Accessed

$15,000 EIDL Loan, $5,945 First-round PPP, $7,713 Second-round PPP

Owner: Darryl Chestnut

Business Start Date: March 2018

What Does Your Business Do?

Darryl owns and operates a commercial cleaning service. His list of clients includes a school, church, community center, and large apartment complex, among others. He is responsible for cleaning and sanitizing these large commercial spaces.

What Inspired You to Start Your Business?

Darryl started working for another cleaning service before he decided to go into business for himself. Since 2018 when he started his business with 2 contracts, he has grown exponentially and continues to gain more contracts.

Before Coming to the CTSBDC, What Were Your Primary Challenges and/or Needs?

After Darryl registered the business, he became aware of SBDC. He was looking for support with all aspects of business. When COVID-19 hit, Darryl was out of work for 4-6 months and needed help navigating the various relief programs available.

How has the CTSBDC helped you overcome your challenges?

Through the help of CTSBDC, Darryl learned how to navigate communicating how his services help stop the spread of COVID, which was critical for his line of work. CTSBDC helped Darryl determine how to operate his business during a pandemic.

What 2-3 things have you learned or changed since working with CTSBDC?

“I’ve learned to be persistent and ask questions. In the beginning, I was nervous about the [COVID-19 relief applications] and [CTSBDC Business Advisor Robert Torra]Bob was able to answer all of my questions. Bob has always been responsive and thorough."

How is your business doing now? What does your future look like?

Darryl’s business is doing very well; he is bringing in more capital and is receiving more hours from existing customers.

What was it like working with your advisor?

“Bob has always been there for me. Bob is helpful because he’s encouraged me to ask questions and helped me learn what I need to know as a first time business owner.”

Did you work with CTSBDC for COVID-19 advising/funding? If yes, please explain.

Yes, I received PPP, EIDL and second draw PPP. Receiving these funds was absolutely critical and helped keep Darryl’s business afloat for the months he could not operate. DC&J received a $15,000 EIDL loan, $5945 in the first draw of the Paycheck Protection Program and $7713 in the second draw.

What words of advice would you give to small businesses looking to work with CTSBDC?

I have referred multiple other business owners to sign up with SBDC. They have been a big help. “During the pandemic, the biggest thing that’s helped me is my SBDC advisor.”

Darryl Chestnut is a hard working business owner. As his Business Advisor, I am happy to see that he is expanding and growing his minority-owned company and feel confident in the future of his business.

- Robert Torra, CTSBDC Capital Access Business Advisor